Alright, let’s get down to the real nitty-gritty of NEMT billing in 2026. If you’re running rides to dialysis, doctor’s appointments, or therapy sessions, you already know the hardest part isn’t the driving, it’s getting paid. That mountain of paperwork, the endless portal logins, the claim denials over a single wrong digit… it’s enough to make you want to shut off the phones.

This isn’t a fluffy overview. This is a raw, detailed map of the billing battlefield in 2026 and a straight-talk guide on how to navigate it. We’re going to strip this process down to its bones, show you exactly where your money is getting stuck, and explain how a modern system, built specifically for this chaos, can turn your completed trips into the cash flow you need to survive and grow.

Why Getting Paid for a Ride Feels Like Running an Obstacle Course in 2026?

Let’s be brutally honest. NEMT billing in 2026 isn’t “billing” in the old sense. It’s a relentless, multi-stage compliance audit that happens for every single trip. You’re not just sending an invoice to a friendly local business. You’re proving to a fragmented, often automated system that a specific person, on a specific day, in a specific vehicle, for a specific reason, was eligible for a specific benefit covered by a specific payer. Miss one box? Claim rejected.

Here’s the reality check on where the complexity explodes:

The Payer Soup:

Gone are the days of one state Medicaid check. Now, you’re dealing with a dozen different payers: the core state Medicaid agency, three different Medicaid Managed Care Organizations (MCOs) like UnitedHealthcare or Molina, national transportation brokers (think ModivCare, MTM, Veyo), maybe a Medicare Advantage plan, and occasionally a private facility or insurance. Each of these is a separate kingdom with its own:

- Portal: A unique website you must log into, each with a different password you’ll inevitably forget.

- Bible of Rules: A 50-page provider manual on what codes to use, what documentation is needed, and how to format everything.

- Claim Format: Some want the HCPCS code T2002 for a non-emergency wheelchair van trip. Another might want A0120. A broker might use its own internal code entirely.

- Countdown Clock: Their “timely filing” deadline. Miss it, sometimes as short as 30 or 60 days from the date of service and that money is gone forever. You just donated a ride.

The Domino Effect of a Tiny Error:

This isn’t about minor delays. A single mistake has a direct, painful cost:

- Instant Rejection: The clearinghouse or payer’s system kicks it back immediately for a formatting error. Fix it, resubmit.

- Pending Purgatory: The claim is accepted but sits in limbo for weeks because the member’s eligibility wasn’t verified for that exact date, or the prior authorization number from the broker doesn’t match their system. Now you’re playing phone tag.

- The Silent Killer – Underpayment: The claim is “paid,” but at the wrong rate. Maybe they paid for a sedan (A0100) when you provided a wheelchair van (T2002). If you’re not meticulously checking every remittance advice, you’re leaving thousands on the table.

- Final Denial: The worst outcome. You missed the deadline, the authorization was expired, or the medical necessity wasn’t documented. The trip is written off. Game over.

This is why using spreadsheets, paper trip sheets, and a folder full of portal bookmarks is a financial death sentence. The system is designed for digital, automated precision, and manual processes are where profit goes to die.

What a Real "Billing & Claims Management" System Actually Does (Beyond Sending Invoices)

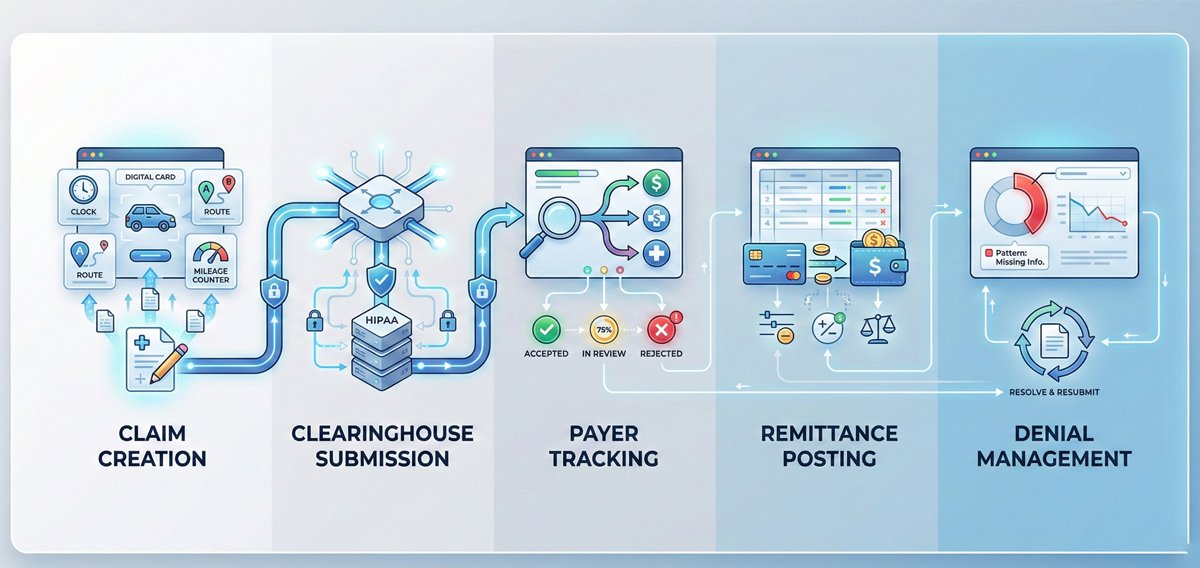

When we talk about a real NEMT billing platform in 2026, we’re not talking about a prettier version of QuickBooks. We’re talking about a specialized engine that automates the entire financial lifecycle of a trip. It needs to handle these five brutal stages:

Claim Creation (The Data Grind):

This is where the magic or the misery happens. The system must take raw trip data (pick-up/drop-off times, addresses, mileage, vehicle type, rider info, driver signature) and automatically translate it into a perfectly formatted claim. It has to know that a trip from a patient’s home (Origin Code: RH) to a dialysis clinic (Destination Code: 81) for a Medicaid MCO member requires code T2002 with modifiers UR (for round trip) and the correct MCO-specific prior authorization number in field loop 2300. Doing this manually for hundreds of trips is impossible without errors.

Clearinghouse Submission (The Digital Highway):

You can’t just email a PDF to Medicaid. Claims must be sent electronically via a HIPAA-compliant clearinghouse, a middleman that translates your claim into standard formats (like EDI 837P) that payer systems can read. A real system submits these directly, in batches, and gets immediate confirmation they were received.

Still Manually Fixing Claims After Submission?

Payer Tracking (Ending the Black Hole):

After submission, the biggest headache is not knowing what’s happening. A real system gives you a dashboard that shows, in plain English: “Claim #12345 for Jane Doe on 10/26: Accepted by Payer,” or “Rejected: Invalid Member ID.” It kills the need to log into Broker Portal #3 just to check a status.

Remittance Posting (The Reconciliation Nightmare):

When payment comes, it’s accompanied by an Electronic Remittance Advice (ERA)—a digital file that says, “We paid $X for claim A, denied claim B for reason CO-16, and adjusted claim C.” A real system automatically imports this ERA, matches payments to your open claims, and explains every adjustment. This is how you find and fight underpayments.

Denial Management (Fighting Back):

This is the strategic layer. The system should categorize denials: “Missing Auth,” “Eligibility Lapse,” “Incorrect Code.” It shows you patterns. If you see 30 denials in a month for “missing prior auth,” you know your dispatch process has a leak, and you can fix it system-wide, recovering future revenue.

A Deep look into How a System Like Caretap Actually Works

Caretap is built specifically for NEMT, which means its billing isn’t a tacked-on module. It’s the end of a connected workflow. Let’s break down what that actually means on the ground.

Your New Centralized Reality: Instead of your billing person having 15 browser tabs open, one for Waystar, one for the ModivCare provider portal, one for the state Medicaid portal, an Excel sheet for trip logs, and an accounting program, they have one single screen in Caretap. Every trip, from the moment it’s dispatched, is already collecting the data needed for the claim.

The Waystar Integration: Your Express Lane to Payers

This is the technical backbone that makes it work. Waystar isn’t just a clearinghouse; it’s the revenue cycle network for healthcare. By building directly into it, Caretap acts as your control panel.

- What it does: When you finalize a trip in Caretap NEMT Billing software, the billing engine validates the data, formats it to payer-specific rules, and shoots it directly through the Waystar connection to the correct payer (Medicaid, a specific MCO, etc.).

- Why it matters for you: You skip manual data entry into Waystar’s portal. You get immediate electronic submission receipts. You receive Electronic Remittance Advices (ERAs) back directly into Caretap, so payments and denials are automatically recorded against the trip. It turns a multi-step, error-prone process into a single click.

See How Caretap Simplifies NEMT Billing

Conquering the Multi-Payer Madness

One of the hardest parts of NEMT billing in 2026 isn’t submitting claims — it’s dealing with multiple payers that all behave differently. State Medicaid fee-for-service, Medicaid MCOs, transportation brokers, and regional programs each come with their own rules, timelines, and documentation requirements.

Modern NEMT billing platforms are designed to account for this reality by allowing providers to manage payer-specific requirements within a single system, rather than relying on spreadsheets, manual checklists, or separate portals.

In practice, this means the system can support configurations for different payer types, including:

Variations in claim formats and submission requirements

Commonly used service codes (such as T2002, A0100, and others, depending on payer and state)

Timely filing limits that differ by payer or contract

Documentation or attachment requirements, such as signatures or trip records

When a trip is completed, the billing workflow uses the payer information already associated with that trip to prepare the claim according to the appropriate requirements. This reduces the need for billers to manually cross-reference provider manuals or reformat claims for each submission.

The result isn’t the elimination of oversight, but a significant reduction in manual effort, guesswork, and preventable errors — especially for providers billing across multiple payers, brokers, or regions.

Tracking the Money: From Black Hole to Glass Box

This is where financial visibility starts to take shape. Within Caretap’s NEMT billing dashboard, providers can monitor the status of submitted claims and payments without relying on multiple payer portals.

Aging Claims Visibility

Instead of seeing a single accounts receivable total, billing teams can review claims by payer and aging range to understand which submissions are still pending and where follow-up may be needed. This helps prioritize outreach rather than chasing every claim blindly.

Payer-Level Trends

Over time, claim and payment data can reveal patterns, such as which payers tend to process claims faster, which generate more denials, or where documentation issues commonly arise. This insight helps providers make more informed operational and contracting decisions.

ERA-Based Payment Posting

When Electronic Remittance Advice (ERA) files are received through the clearinghouse connection, payments and adjustments are applied back to the corresponding claims. Adjustment and denial reason codes are visible, making it easier to identify discrepancies, investigate underpayments, and determine whether an appeal is warranted.

Killing Errors at the Source and Protecting Cash Flow

Most billing errors aren’t caused by people — they’re caused by broken processes and manual handoffs. Every time trip data is written down, retyped, or copied between systems, the risk of error increases.

The Traditional Workflow

In many operations, mileage and trip details pass through multiple steps — from dispatch notes to driver logs, spreadsheets, and finally into payer or broker portals. Each transition introduces the possibility of small mistakes that can lead to denials, delays, or underpayments.

A More Connected Approach

In a connected NEMT platform, trip details entered at dispatch flow through the system and are reused throughout the billing process. Mileage can be calculated using mapping tools, drivers can confirm trip completion through a mobile app, and documentation is stored with the trip record — reducing the need for repeated manual entry.

This same principle applies across key data points:

Eligibility: Verified electronically when available, rather than assumed

Prior Authorization: Entered once and referenced across related trips

Driver Documentation: Digital confirmations and signatures stored with trip records

Service Codes: Suggested based on vehicle type and trip details, helping reduce coding errors

The result is fewer preventable mistakes, fewer reworked claims, and a higher percentage of claims submitted cleanly the first time — helping providers spend less effort on corrections and get paid faster.

The Hard Truth: Cash Flow is Your Business, Not Trip Volume

You can have a fleet of 50 vehicles running 500 trips a day and still go bankrupt. How? If your billing cycle is 75 days long and your denial rate is 20%, you’re financing your payers’ operations with your own line of credit. You’re cash-poor.

The goal of a system like this is to compress that cycle and capture every dollar you’ve earned.

- Submit Claims Faster: Go from batching claims once a week to submitting them daily or even automatically at trip completion. Shave 6 days off your submission time.

- Track Relentlessly: Know the status of every dollar, so you can follow up on pended claims at 30 days, not 90.

- Attack Denials Systematically: Use the denial reports to fix operational leaks. Train dispatchers on auth requirements. Train drivers on documentation. Stop the same error from happening 100 times.

- Post Payments Instantly: Eliminate the week-long lag of manually applying checks and ERAs to your accounting. Know your real cash position daily.

This isn’t just “efficiency.” This is transforming your billing office from a reactive cost center into a proactive profit center. It’s about turning your accounts receivable that nebulous, stressful number into cash in the bank.

Who is this for? It’s for the Medicaid provider tired of broker portals. It’s for the growing fleet adding private contracts and needing one system to handle it all. It’s for the owner who’s sick of financial surprises and wants to see, in real numbers, how their business is truly performing.

Conclusion: It's Time to Stop Working for Free

Let’s end with the raw truth. NEMT is a tough, essential service. Your drivers work hard. Your dispatchers hustle. You shouldn’t lose money because of a bureaucratic puzzle built on outdated, manual processes.

The difference between struggling and thriving in 2026’s NEMT landscape is connected data. It’s having a system where the trip, the documentation, the rules, and the claim are all part of one unbroken chain. It’s about replacing hope and hustle with visibility and control.

A platform like Caretap, with its NEMT-native billing engine and direct pipeline to payers via Waystar, isn’t a luxury. For the serious provider, it’s the new baseline. It’s the tool that finally allows you to get paid accurately and on time for the vital service you deliver every single day. Because in the end, a trip isn’t complete when the patient gets home. It’s complete when you get paid.